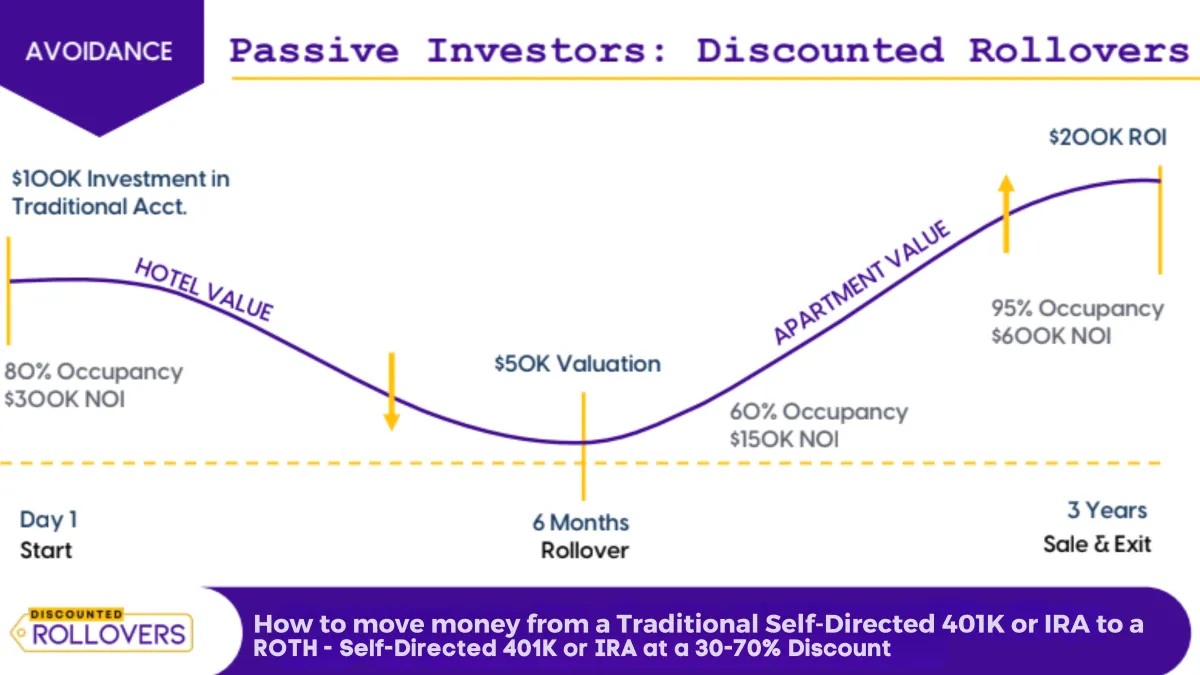

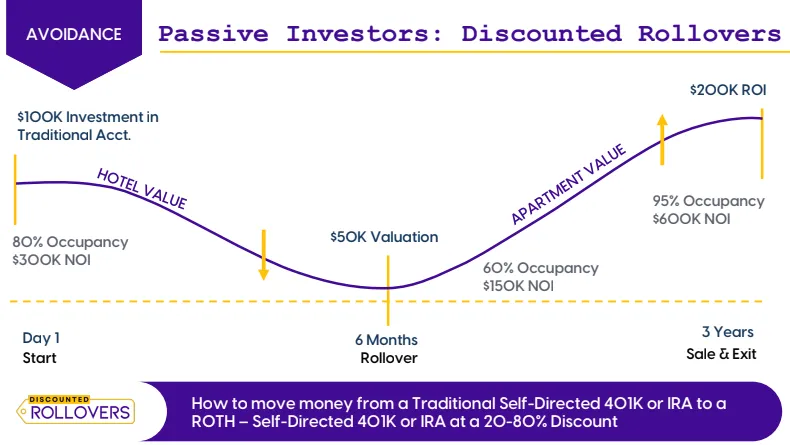

30–70% Discounted Rollovers from

Traditional to Roth Retirement Accounts

Maximize your Retirement.

Minimize the Tax.

Rolling over money from a Traditional IRA or 401(k) to a Roth account usually comes with a hefty tax bill. But what if you could legally reduce that cost by 30–70%?

With our Discounted Rollover strategy, you can convert pre-tax retirement funds to a Roth account at a reduced taxable value, unlocking tax-free growth for life, at a fraction of the usual tax cost.

Rolling over money from a Traditional IRA or 401(k) to a Roth account usually comes with a hefty tax bill. But what if you could legally reduce that cost by 30–70%?

With our Discounted Rollover strategy, you can convert pre-tax retirement funds to a Roth account at a reduced taxable value, unlocking tax-free growth for life, at a fraction of the usual tax cost.

Why Use This Strategy?

Led by Keith Blackborg, a former CPA and family office advisor, and Gabe Hogan, a valuation expert and CEO of Palmettos Tax. Their combined experience ensures your rollover is both tax-efficient and investment-smart.

Accelerated Wealth Growth

Once converted, your investment grows entirely tax-free in a Roth account-maximizing long-term compounding and future flexibility.

Smart Tax Efficiency

Convert Traditional retirement funds to Roth at a 30–70% discount, significantly reducing your upfront tax bill and keeping more money working for you.

Timing-Based Advantage

This strategy takes advantage of temporary dips in asset value, such as during real estate rehabs or market fluctuations, turning short-term volatility into long-term gains.

Multiply your Tax Advantages

Pair this with advanced techniques like Family Limited Partnership discounts to unlock even more tax savings and optimize your investment structure.

Why Use This Strategy?

Led by Keith Blackborg, a former CPA and family office advisor, and Gabe Hogan, a valuation expert and CEO of Palmettos Tax. Their combined experience ensures your rollover is both tax-efficient and investment-smart.

Accelerated Wealth Growth

Once converted, your investment grows entirely tax-free in a Roth account-maximizing long-term compounding and future flexibility.

Smart Tax Efficiency

Convert Traditional retirement funds to Roth at a 30–70% discount, significantly reducing your upfront tax bill and keeping more money working for you.

Timing-Based Advantage

This strategy takes advantage of temporary dips in asset value, such as during real estate rehabs or market fluctuations, turning short-term volatility into long-term gains.

Multiply your Tax Advantages

Pair this with advanced techniques like Family Limited Partnership discounts to unlock even more tax savings and optimize your investment structure.

How it Works

How it Works

Invest through your self-directed Traditional IRA or 401(k).

Identify a temporary dip in asset value (e.g. real estate under rehab).

Rollover the asset at the reduced value into a Roth account.

Grow your investment tax-free for life.

Invest through your self-directed Traditional IRA or 401(k).

Identify a temporary dip in asset value (e.g. real estate under rehab).

Rollover the asset at the reduced value into a Roth account.

Grow your investment tax-free for life.

Stay Ahead with

Smart Strategies

Join our email list to be notified of new investment opportunities when they become available.

Get exclusive insights on discounted rollover strategies, updates on retirement tax planning, and early access to tools and opportunities for maximizing your retirement accounts.

Stay Ahead with Smart Strategies

Join our email list and get exclusive insights on discounted rollover strategies, updates on IRS-compliant planning, and early access to tools and opportunities for maximizing your retirement accounts.

Our goal is to make this one of the most valuable free resources for advanced tax planning and long-term wealth building.

FAQs

What is a Discounted Rollover?

A Discounted Rollover is a tax strategy that allows you to convert Traditional, pre-tax, retirement funds (like IRAs or 401(k)s) to Roth, post-tax, retirement accounts while significantly reducing the taxes owed. It works by investing in a temporarily devalued asset and using a third-party valuation to value the rollover at lower taxable amount as of the date of conversion.

How does this help reduce taxes on Roth conversions?

The IRS taxes Roth conversions based on the fair market value of the asset at the time of conversion. By investing in a qualified asset that has a predictable drop in value, and verifying that with a professional valuation, you can convert at the lower value. Once the asset recovers, your Roth account grows tax-free from a lower tax basis.

Is this legal and IRS compliant?

Yes. This strategy follows established IRS guidelines for Roth conversions and valuation standards. We work with experienced tax attorneys, CPAs, and third-party valuation firms to ensure full compliance. In fact, one of our owners is a tax attorney and former IRS auditor who is very interested in ensuring everything is compliant.

Our Audit Protection Guarantee means we will represent the transaction and valuation before the IRS.

Who is this strategy ideal for?

This strategy is best suited for accredited investors, high-income professionals, or anyone with substantial funds in Traditional, pre-tax, retirement accounts who want to reduce their future tax liability by tax efficiently moving funds to a Roth, post-tax retirement account. It’s especially powerful for those planning to grow their wealth tax-free or pass assets to heirs efficiently. Most of the investments have an investment minimum of $50K or $100K.

How much can I save using this approach?

The typical tax savings is 30-70% depending on the investment. We can never promise a specific result before the valuation is completed, but we're not interested in sharing any investment delivering less than an anticipated 30% discount. We typically provide an estimated discount for an investment.

Tax savings vary based on your account size, tax bracket, and the valuation discount applied, but many clients save tens of thousands, sometimes hundreds of thousands, in upfront taxes. Our calculator can help you run your own numbers, or you can book a call to walk through your unique situation.