See how much you could save before making any decisions.

Use the calculator to test different rollover amounts and valuations.

You’ll see how much you save in taxes when you complete a Roth conversion at a discounted value.

Traditional to Roth Conversion Estimator

The minimum investment is $50-100K for most investments. We anticipate at least a 30% Discount on all investments.

Input your estimated marginal tax rate.

There is a one-time Tax Owed on the Rollover to move money from your Traditional to your Roth retirement account.

The Initial Tax Savings result from the discount achieved on the asset valuation through the rollover.

Roth Growth Estimator

The REAL value of a Discounted Rollover is the future tax-free growth and tax-free distributions from a Roth.

12% is the minimum projected investment return we'll share.

With the right strategy, your Roth retirement account has the capacity to grow large, provide for your family and leave a truly meaningful legacy!

See how much you could save before making any decisions.

Use the calculator to test different rollover amounts and valuations.

You’ll see how much you save in taxes when you complete a Roth conversion at a discounted value.

Traditional to Roth Conversion Estimator

The minimum investment is $50-100K for most investments. We anticipate at least a 30% Discount on all investments.

Input your estimated marginal tax rate.

There is a one-time Tax Owed on the Rollover to move money from your Traditional to your Roth retirement account.

The Initial Tax Savings result from the discount achieved on the asset valuation through the rollover.

Roth Growth Estimator

The REAL value of a Discounted Rollover is the future tax-free growth and tax-free distributions from a Roth.

12% is the minimum projected investment return we'll share.

With the right strategy, your Roth retirement account has the capacity to grow large, provide for your family and leave a truly meaningful legacy!

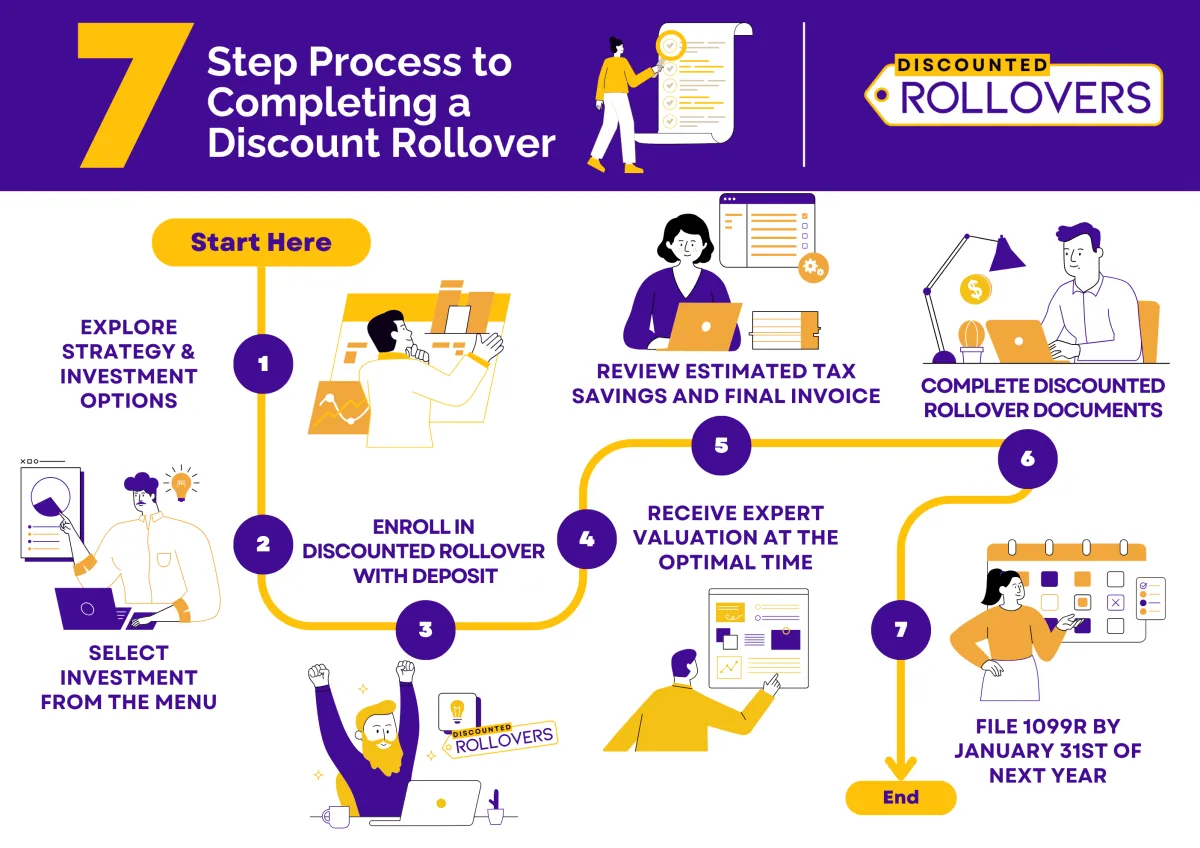

How it Works

Stay Ahead with

Smart Strategies

Join our email list to be notified of new investment opportunities when they become available.

Get exclusive insights on discounted rollover strategies, updates on retirement tax planning, and early access to tools and opportunities for maximizing your retirement accounts.

FAQs

How does this benefit me as an investor?

The Discounted Rollover strategy helps you convert pre-tax retirement funds (like Traditional IRAs or 401(k)s) into Roth accounts while legally reducing the taxes owed. That means more of your money grows tax-free, and you keep more of your wealth in the long run.

What types of investment qualify for a discounted rollover?

To qualify, the investment must have a predictable short-term drop in value, followed by a strong likelihood of recovery. These are typically illiquid, privately held assets structured to allow for a professional, supportable valuation.

Will this affect my liquidity or access to funds?

This strategy works best with funds you don’t need immediate access to. While the investments used are intended to recover in value and generate returns, they may have holding periods or lockups.

Is there a minimum account size or investment requirement?

Yes. To justify the cost of implementation and make the tax savings meaningful, this strategy typically makes sense for investors with at least $100K in pre-tax retirement assets available to convert.

Can I use this strategy more than once?

Yes. Many of our clients use this strategy in multiple years or with different investments over time. We can help you structure a long-term conversion plan to maximize tax efficiency over several phases.